new mexico gross receipts tax return

Tax rate changes. Simplify New Mexico sales tax compliance.

Gross Receipts Location Code And Tax Rate Map Governments

If you are engaged in business in new mexico you must file a new mexico tax return and pay gross.

. New Mexico Taxpayer Access Point allows taxpayers to file their taxes make payments check refund statuses manage their tax accounts register new businesses and more. Taxpayers report their total gross receipts and any. 6 - Form TRD-41413 Gross Re-ceipts Tax Return and Schedule A 1 - Form 41413 Gross.

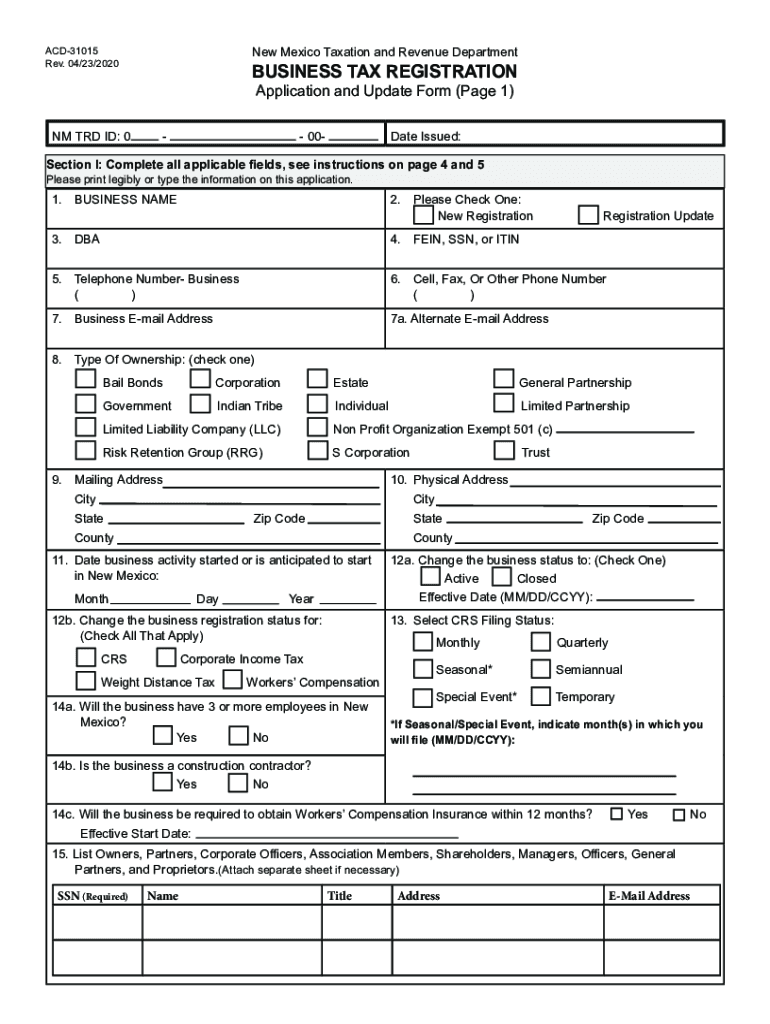

The tax is imposed on the gross receipts of persons who. A gross receipts tax permit can be obtained by registering for a CRS Identification Number online or submitting the paper form ACD-31015. Effective for January 1 2020 the corporate income tax rate is 48 percent for taxable income up until 500000.

New Mexicans who do not file taxes will be able to apply for relief payments starting Monday May 2 2022 at 800am. We provide sales tax rate databases for. Anything over 5125 percent represents local option rates imposed by counties and.

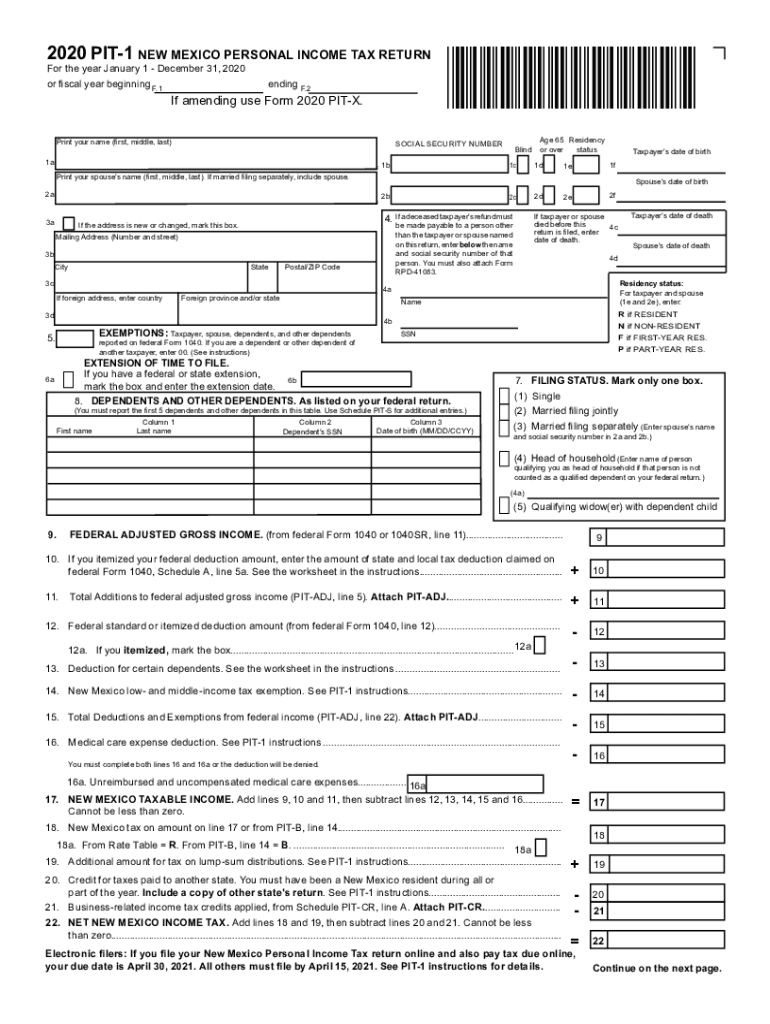

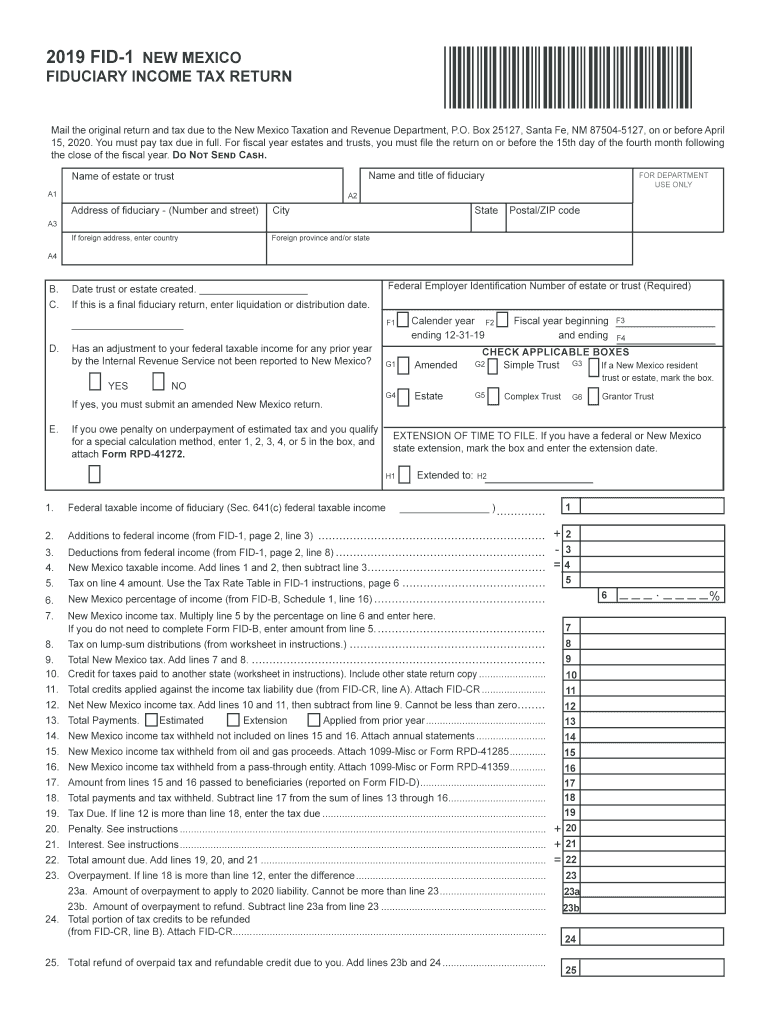

10 Your Rights Under the Tax Law. For fiduciaries that file on a calendar-year basis the New Mexico FID-1 New Mexico Fiduciary Income Tax Return is due on or before April 15 with the payment of taxes due. Gross Receipts Tax Compensating Tax and Governmental Gross Receipts Tax IMPOSITION AND DENOMINATION 7-9-4.

After registering the business will be. New mexico gross receipts tax changes. Jul 8 2020 Jobs the Economy Other Affected Services Tax and Rev.

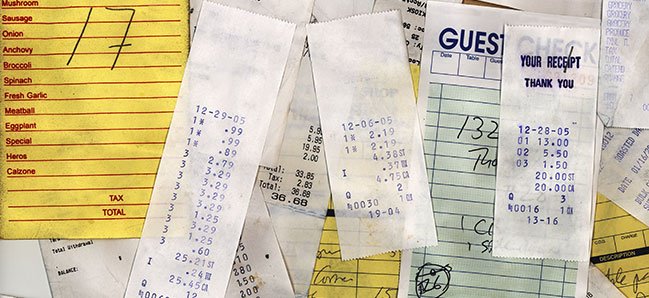

The gross receipts tax is a tax on persons engaged in business in New Mexico for the privilege of doing business in New Mexico. Enter the total amount of gross receipts excluding tax here. Denomination as gross receipts tax.

Gross Receipts Location Code and Tax Rate Map. NM Business Taxes. Relief payments will be issued on a first-come first.

If Schedule A pages are attached enter total of columns D and I. The governors office said the proposed redu. New Mexico Taxation and Revenue Department GOVERNMENTAL GROSS RECEIPTS TAX RETURN This report can be filed online at httpstapstatenmus I declare that I have.

Each Form TRD-41413 is. AEnter the total amount of gross receipts tax due here. It varies because the total rate combines rates imposed by the state counties and if applicable municipalities where the.

Generally a business will pass that tax on to the consumer so that it resembles a sales tax. Property includes real property tangible personal property including electricity and manufactured homes licenses other than. SANTA FE New Mexico personal and corporate income tax returns for 2019 must be filed by July 15 to.

Filing New Mexico gross receipts tax Gross receipts tax is reported on the TRD-41413 Gross Receipts Tax Return. The tax is imposed on the gross receipts of persons who. The gross receipts tax rate varies statewide from the state base of 5125 percent to 88125 percent.

GROSS RECEIPTS TAX RETURN GENERAL INFORMATION This document provides instructions for the New Mexico Form TRD-41413 Gross Receipts Tax Return. New Mexico does not have a sales tax like other states we have a Gross Receipts Tax which means businesses pay a tax on their total receipts minus any non-taxable deductions. If you are engaged in business in New Mexico you must file a New Mexico tax return and pay gross receipts tax for the privilege of doing business in New Mexico.

The document has moved here. Who Must File A Gross Receipts Tax Return The gross receipts tax is a tax imposed on persons engaged in business in New Mexico for the. The gross receipts tax rate varies throughout the state from 5125 to 86875 depending on the location of the business.

This means there will no longer be a difference in rates between the two taxes. Sell property in New Mexico. And 12 New Mexico Taxpayer Bill of Rights.

14 For taxable income exceeding 500000. Imposition and rate of tax.

A Guide To New Mexico S Tax System New Mexico Voices For Children

New Mexico Sales Tax Small Business Guide Truic

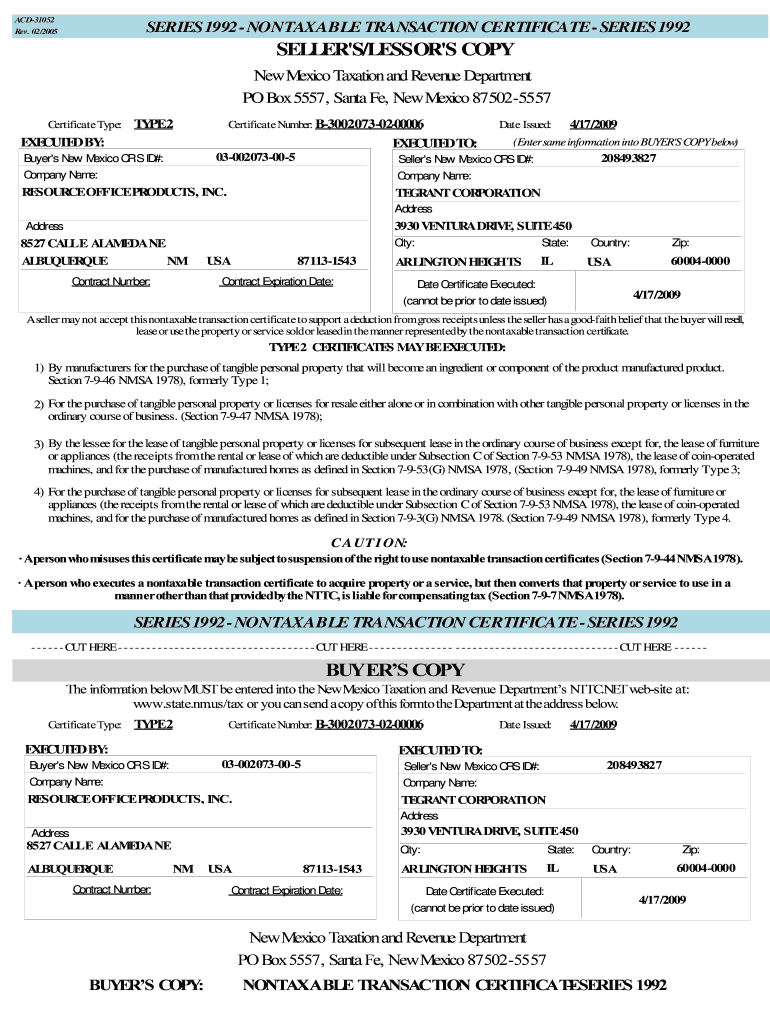

Nm Acd 31052 2005 2022 Fill Out Tax Template Online Us Legal Forms

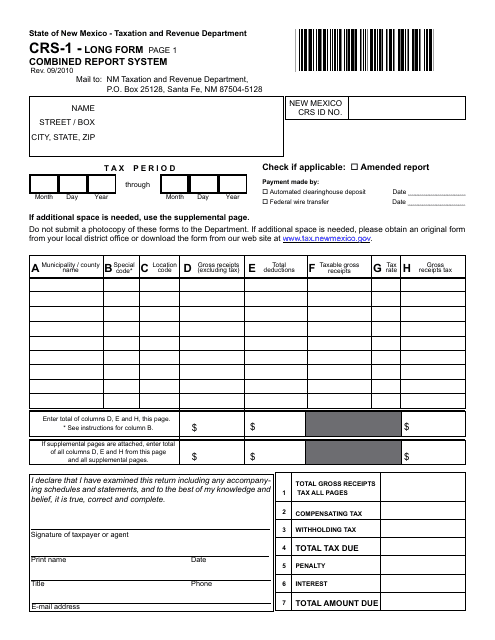

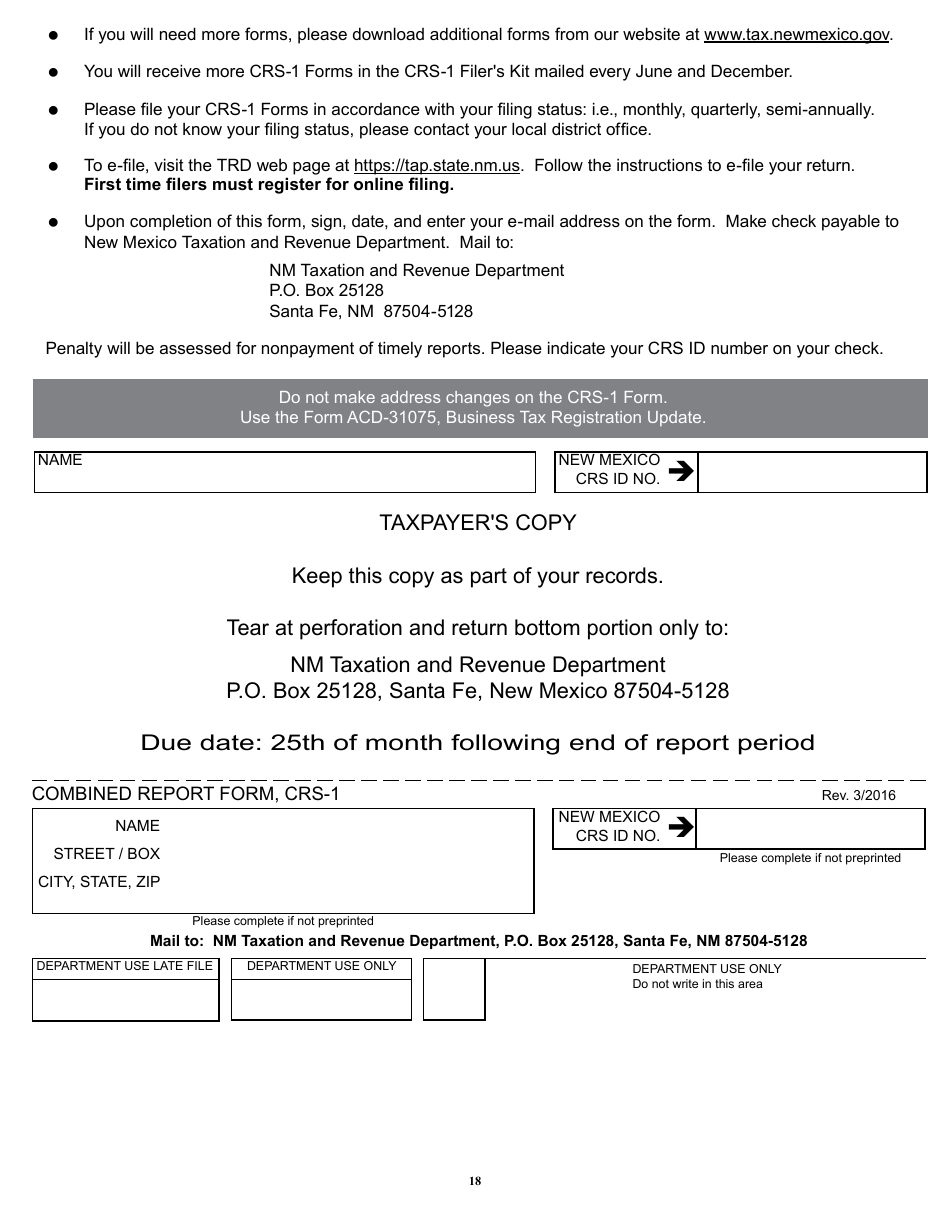

Form Crs 1 Download Printable Pdf Or Fill Online Combined Report Long Form New Mexico Templateroller

Form Crs 1 Download Printable Pdf Or Fill Online Combined Report Long Form New Mexico Templateroller

How To File And Pay Sales Tax In New Mexico Taxvalet

Nm Lodgers Tax Report 2020 2022 Fill Out Tax Template Online Us Legal Forms

A Guide To New Mexico S Tax System Executive Summary New Mexico Voices For Children

Nm Trd Pit 1 2020 2022 Fill Out Tax Template Online Us Legal Forms

Revenue Windfall Could Prompt Tax Cut Talks Albuquerque Journal

New Mexico Gross Receipts Tax Nmgrt Law 4 Small Business P C L4sb

Online Services Taxation And Revenue New Mexico

A Guide To New Mexico S Tax System New Mexico Voices For Children

Nm Trd Fid 1 2019 2022 Fill Out Tax Template Online Us Legal Forms

How To File And Pay Sales Tax In New Mexico Taxvalet

Form Crs 1 Download Printable Pdf Or Fill Online Combined Report New Mexico Templateroller